The introduction of possible tariffs on imports by the U.S. is contributing to an unpredictable market environment in 2025.

While we don’t know specifics, we do know they will affect the metal industry.

These tariffs are expected to impact a wide range of industries, from construction and automotive manufacturing to appliances and packaging. As the global market adjusts to these new trade policies, businesses will need to navigate increased costs, supply chain disruptions, and potential retaliatory actions from major trading partners.

In this blog, we’ll explore possible steel and aluminum tariffs, their potential impact on various industries, and how businesses can adapt to the evolving market landscape.

Overview of Metal Tariffs

Tariffs are taxes imposed on imported goods from other countries. They are often used to protect local industries by promoting internal trade.

Metal tariffs are when a company, whether automotive or construction, imports metal from an international supplier, they will have to pay a tax on it to the U.S. government.

Recent History of Metal Tariffs in the U.S.

Tariffs on steel and aluminum are not a new concept for the U.S.:

- 2002: U.S. government imposed tariffs of up to 30% on steel imports.

- 2018: The U.S. government imposed a 25% steel tariff and a 10% tariff on aluminum under Section 232 of the Trade Expansion Act, citing national security concerns. The tariffs sparked retaliation from key trading partners, including Canada, Mexico, and the European Union (EU).

- 2025: The new tariffs are expected to match the 2018 levels. However, the global trade landscape has shifted since 2018, increasing the risk of economic disruption.

So what are the proposed metal tariffs for 2025?

Different Types Of Metal Tariffs Proposed

The White House announced that there are plans to impose metal tariffs. Countries mentioned for import tariffs include China, Canada, Mexico, and India.

Many previous exemptions are being removed to crack down on loopholes.

Steel Tariff

There is a proposal for tariffs on imported steel covering all forms of steel products, including raw steel, coils, sheets, and finished products. Currently, the White House plans to continue the 25% steel tariff.

Aluminum Tariff

Similarly, a tariff on imported aluminum is proposed to apply to raw aluminum, aluminum sheets, foil, and extrusions. The proposed aluminum tariff has increased from 10% in 2018 to 25% in 2025.

Potential Impact of Tariffs

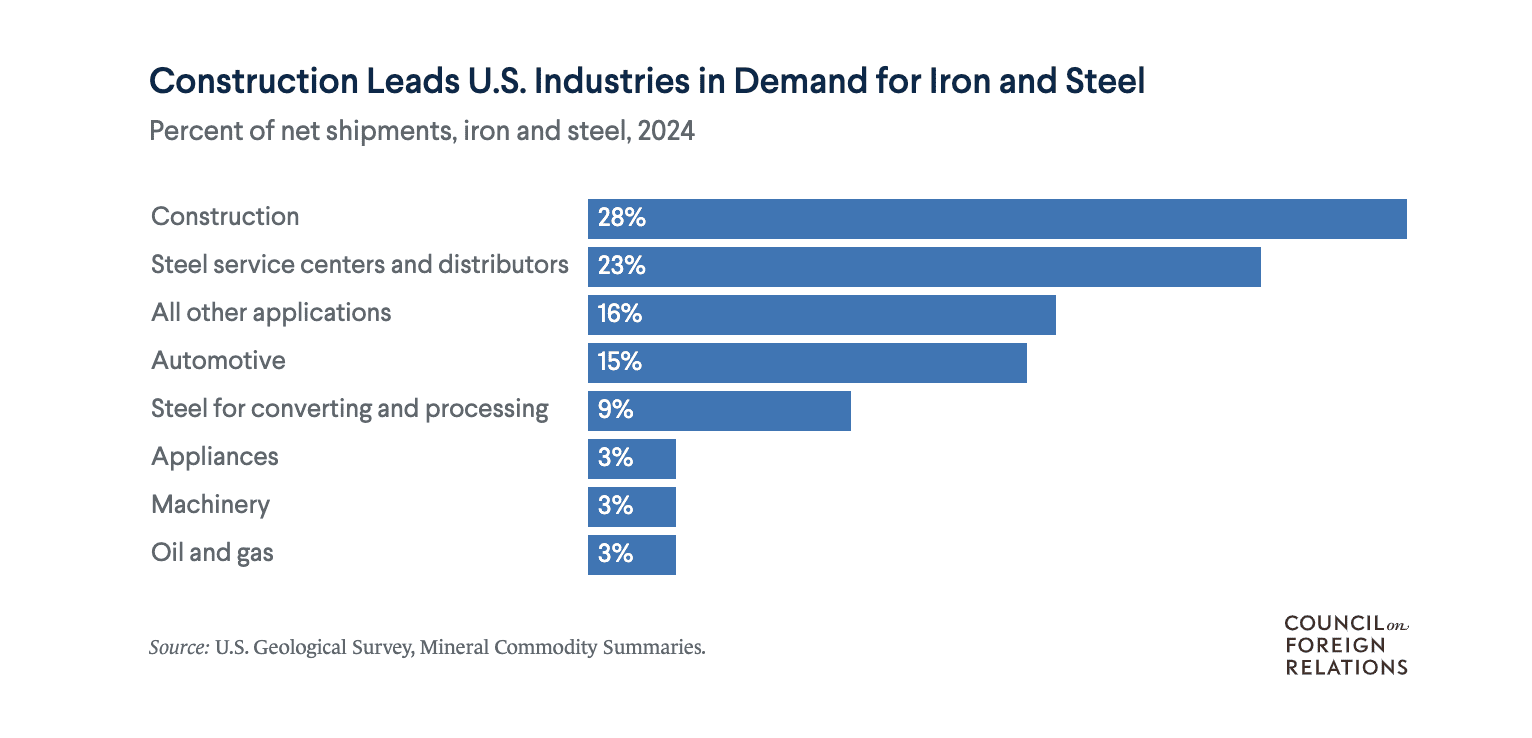

Tariffs on metal will hit construction, automotive, packaging, appliances, machinery, oil and gas, and electrical industries the hardest.

Construction

Higher steel and aluminum costs could increase overall construction expenses. Building materials such as structural steel, roofing materials, and aluminum siding may become more expensive.

Contractors and developers might need to pass these costs on to consumers, resulting in higher property prices and reduced profit margins.

Automotive

Steel and aluminum are key materials in vehicle manufacturing. Higher material costs could lead to increased vehicle prices for consumers.

U.S. automakers may reduce production or shift manufacturing to countries with lower tariffs to remain competitive.

Packaging

Aluminum is widely used in the packaging industry such as in beverage cans or food containers. Aluminum tariffs could increase the cost of packaging, forcing companies to either raise prices or absorb the extra expense.

Appliances

Household appliances such as refrigerators, ovens, and washing machines rely heavily on steel and aluminum components.

Manufacturers may pass on the increased costs to consumers, driving up retail prices.

Machinery

Heavy machinery and industrial equipment are often manufactured using steel and aluminum. Tariffs could raise manufacturing costs, making American products less competitive in the global market.

Oil and Gas

The energy sector relies on steel for drilling rigs, pipelines, and refining equipment. Higher steel prices could increase operational costs, affecting both production and profitability.

Electrical Industry

Electrical infrastructure, such as transformers and wiring, requires steel and aluminum. Increased material costs could lead to higher prices for electrical projects and infrastructure upgrades.

How Will Tariffs Affect Scrap Metal Prices

So what does this all mean for the scrap metal industry?

Increased Scrap Metal Prices

As tariffs make imported metals more expensive, demand for domestically sourced materials will increase. This includes scrap metal, which could see a significant rise in prices as manufacturers look for affordable alternatives to imported materials.

Market Uncertainty

Tariffs often lead to volatility in global metal markets. Supply chain disruptions could make it difficult to predict the availability and pricing of metal.

Additionally, trade partners may seek alternative markets for their exports, further reshaping global supply chains.

The uncertainty surrounding tariff negotiations and potential retaliation could lead to price instability.

Potential International Response To Tariffs

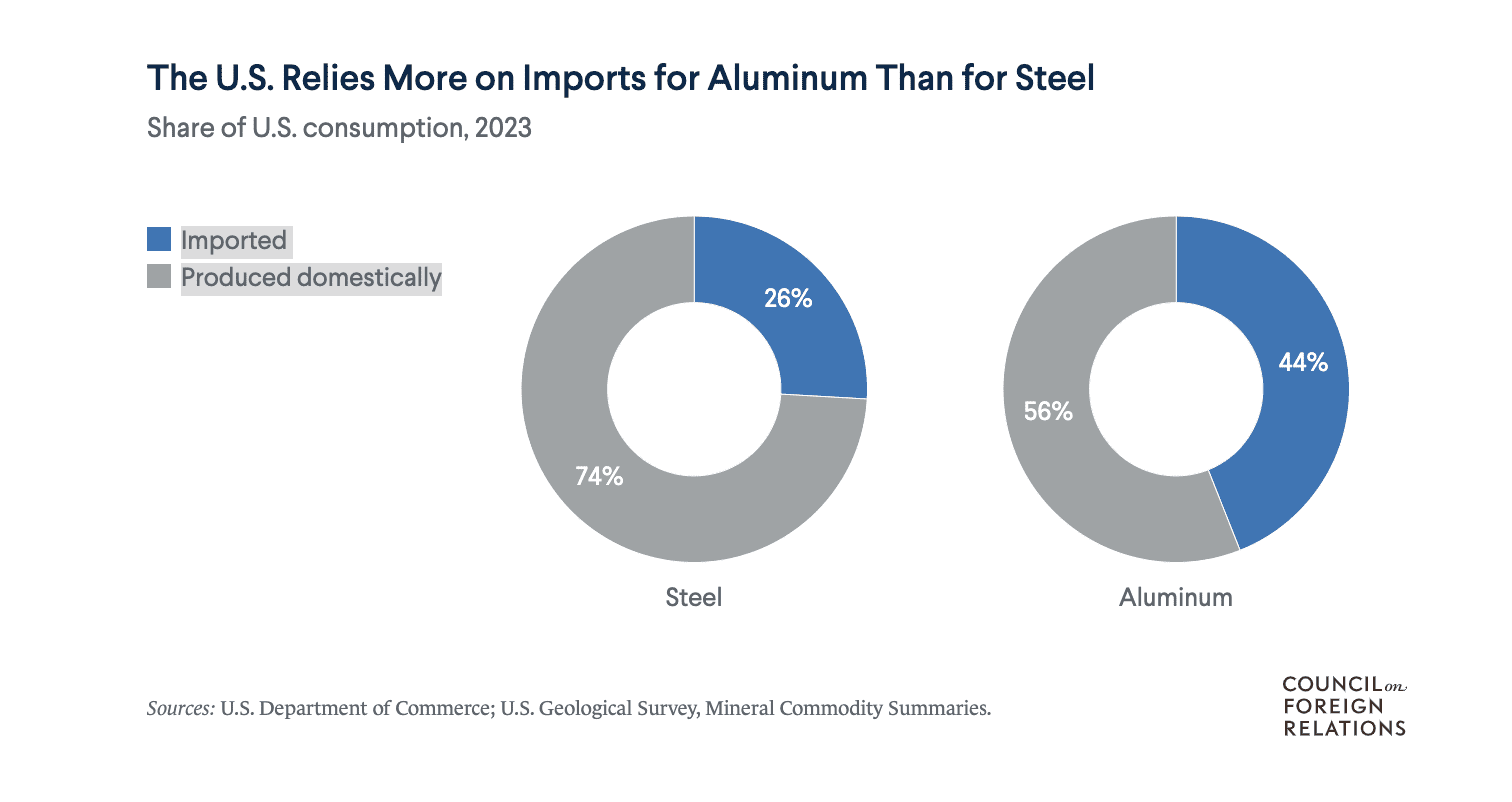

The U.S. relies heavily on metal imports from other countries and maintains extensive trade relationships worldwide. These tariffs could have significant ripple effects on global relations and the economy.

Canada

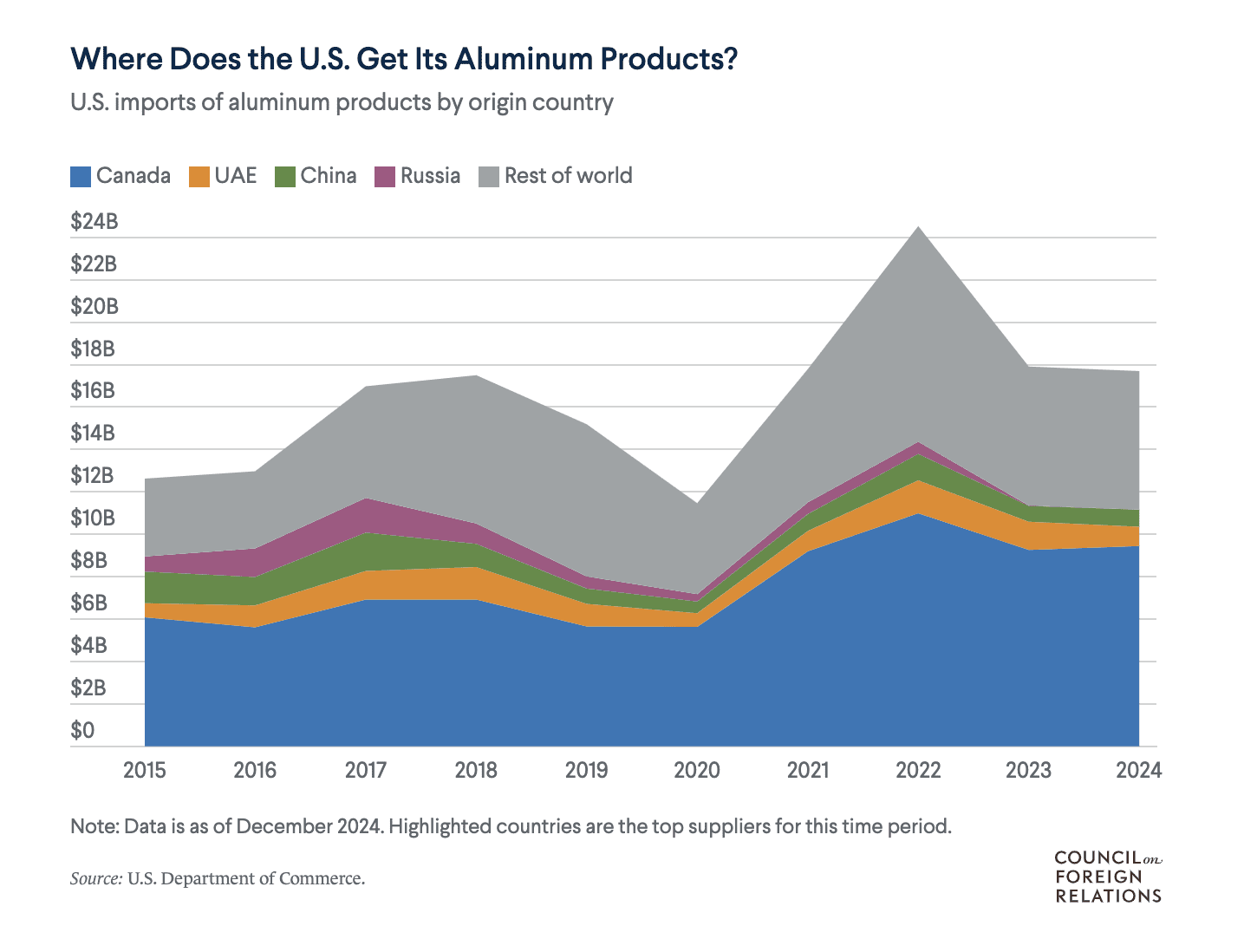

Canada is one of the largest suppliers of steel and aluminum to the U.S. In response to the tariffs, Canada could impose retaliatory tariffs on U.S. goods or seek to renegotiate existing trade agreements.

Canada may also look to strengthen trade relationships with other global markets to offset the impact of lost U.S. business.

European Union (EU)

The EU has already announced plans to impose tariffs on up to $28 billion worth of U.S. exports in response to the new metal tariffs.

The EU could challenge the tariffs through the World Trade Organization (WTO), arguing that they violate international trade agreements.

Retaliatory measures could include increased tariffs on American-made automobiles, agricultural products, and industrial equipment.

China

China is a major exporter of steel and aluminum to global markets but not directly to the U.S. China could redirect its exports to other regions, increasing competition for European and Asian producers.

China might also introduce tariffs on key American exports, including agricultural products and technology.

Recycle Your Metal With GLE

No matter what tariff developments occur, we know one thing, recycling metal will become increasingly important. Companies that recycle play a crucial role in helping to meet the growing demand for domestic metal sources.

By recycling your metal with GLE, you contribute to a sustainable supply chain and support the domestic economy amid rising tariff concerns. Request a quote today to get started.